One Step Closer to a Digital Pakistan

3 July, 2022

Healthcare Data: The Race for New Oil in Southeast Asia

29 July, 2023

2023 Outlook — Fintech everything everywhere all at once

1 February, 2023

Much has been written about high inflation, slowing growth, valuation multiple contraction and rising interest rates. But despite the lingering effects of the COVID-19 pandemic and the many macroeconomic concerns, our conviction over the region’s potential stays strong. Here are just a few of the sub-sectors within fintech and healthtech which we think are poised to capitalise on present conditions and would perform well in 2023.

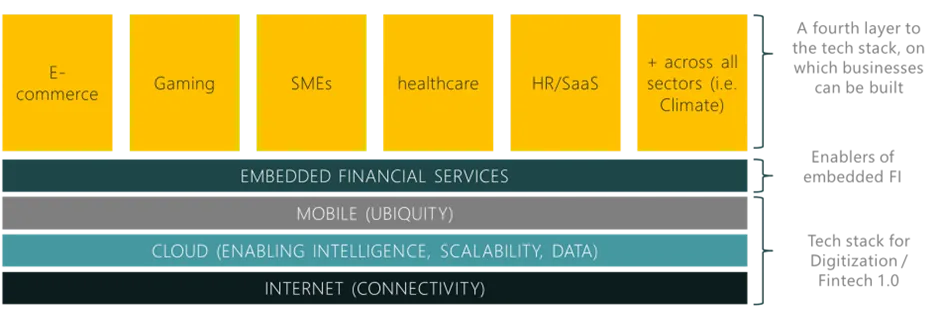

Embedded fintech. Accelerated.

Our medium term thesis that fintech is becoming a horizontal layer, embedded across all industries, continues to hold true and accelerates as companies seek more monetisation opportunities and disintermediate expensive channels. In the past, financial services were typically offered by banks and other financial institutions, and were only used by consumers and businesses in specific contexts such as making a purchase or obtaining a loan. Data made it possible for fintech companies to create new, more personalised financial services tailored to the specific needs of different sectors and industries. We have seen financial services integrated into literally every industry across the region — from agriculture (eFishery offering credit to farmers), logistics (Kargo financing truck drivers), eCommerce (Graas providing revenue based financing to brands), to climate (Cleanhub creating a market for plastic credits), just to name a few. To echo Angela Strange from A16z, “Every Company Will Be a Fintech Company”. This trend continues to hold true, although not all companies in this region will derive a “significant portion of their revenue from financial services” as she puts it, most will eventually incorporate financial services as a revenue stream.

From Inflation to adaptation

As inflation continues to rise, we anticipate increased demand for solutions that help consumers adapt to the higher cost of living, therefore digital solutions that reduce costs or increase access to essential goods and services, such as healthcare, housing, and education, will likely benefit from a thriftier consumer sentiment.

Fintech companies that provide financing for non-discretionary expenses, such as earned-wage access platforms, continue to demonstrate strong growth potential. These platforms, such as Wagely in Indonesia and Bangladesh, Gimo in Vietnam, and Advance.ph in the Philippines, assist people living paycheck to paycheck with managing unexpected expenses and the increasing cost of necessities.

From inflation to disruption

We expect surging prices and tightened purse strings to accelerate the shift to more cost-efficient real-time payment options across the region. Merchants who typically absorb the 3–4% transaction fee from traditional forms of payment, such as credit and debit cards might find themselves particularly hard hit, especially for smaller tickets and lower margin products and services. Where they previously could pass on that cost to consumers, they now risk alienating those with tightened budgets. This shift could be the needed catalyst that disrupts the status quo and allows for real-time payment options like direct bank transfers and inexpensive e-wallets payments to overtake card payments.

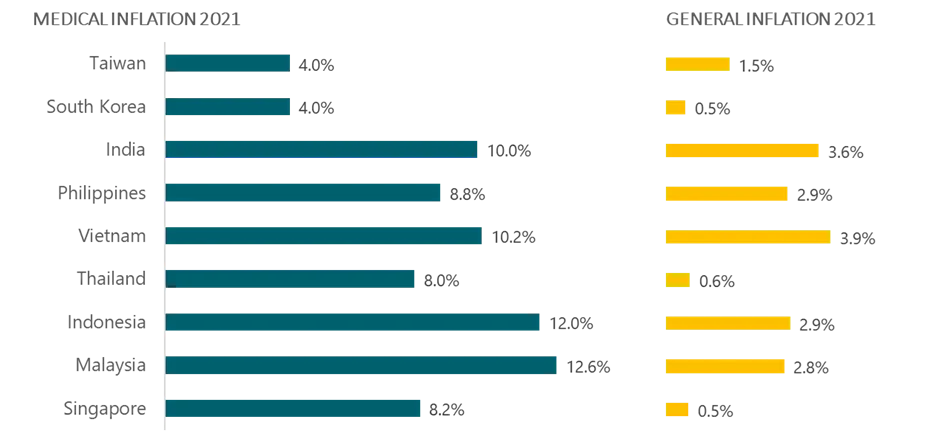

What’s worse than inflation? … healthcare inflation

Another pressing concern for Southeast Asia is the escalating cost of healthcare. Medical inflation in the region is roughly 3 to 8 times higher than general inflation, but in Singapore that deviation reached 16x in 2021. With inflation creeping up across the region, healthcare is expected to become increasingly unaffordable for many. Solutions aimed at reducing healthcare costs will become a focal point in the coming year; companies like HealthMetrics, for example, are on our radar for helping employers keep medical insurance costs low by increasing transparency and fostering market competition, while Naluri helps insurers reduce employee wellness claims-ratio. Buy-now-pay-later solutions such targeted at non-discretionary healthcare needs, like CareNow in Indonesia and SaveIN in India, are also emerging to provide much-needed relief for those struggling with the rising costs of healthcare.

While these solutions may enjoy reduced customer acquisition costs over the coming years, those that will build a long-term sustainable business will be the ones that can retain the customers, better understand them, and innovate to offer additional value-added services.

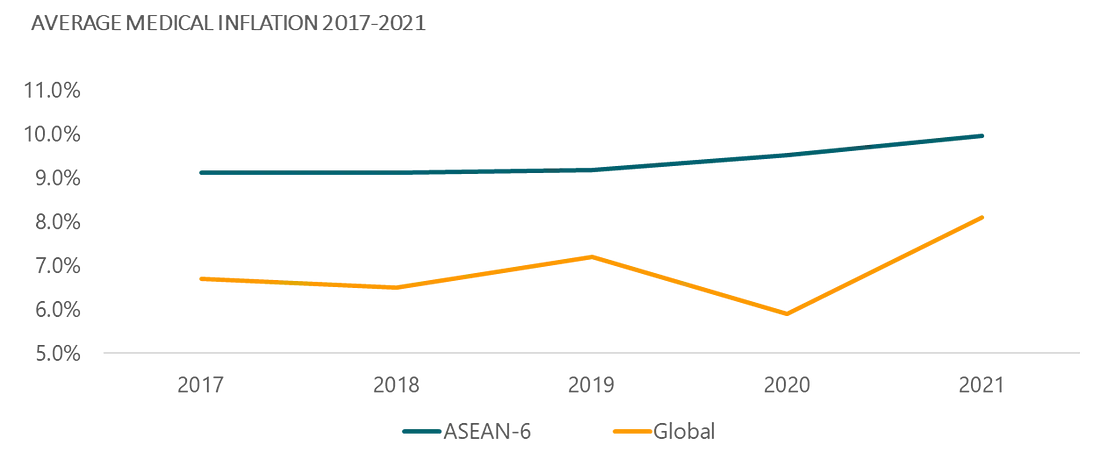

Higher healthcare costs equal higher healthcare GMV

As expectations that healthcare inflation rises in Southeast Asia, platforms that digitise price-inelastic healthcare demand are likely to benefit. One such area is in the maternity and infant health space. These start-ups are likely to see embedded gross merchandise value growth due to inflation alone, in addition to benefiting from the growing demand on the back of greater awareness about maternity and infant health. The ASEAN-6 countries alone had 11.5 million new births in 2022, up from 9.7 million in 2020, with Indonesia contributing almost half of the new births.

Contributed partially by higher price tags, we see GMV growth from maternity and infant health marketplaces such as Supermom and Concung, as well as direct-to-consumer brands such as MotherCare and MOOIMOM. On the healthtech side, companies like myKindred in the Philippines are taking a digital yet holistic approach to obstetrics and gynaecology, offering more accessible options for care. This trend highlights the potential for digital health platforms to play a significant role in both addressing the rising costs of healthcare in the region by providing accessible and affordable healthcare solutions to consumers, while benefiting from the trend of higher healthcare costs.

Time to refinance that mortgage

Shifting gear towards the rising interest rates and associated opportunities, we see bright spots in the home-finance space. As interest rates rise, home ownership becomes increasingly challenging for many. In January 2023, mortgage rates in Southeast Asia averaged 7%¹ with expectations for further increases. This trend is likely to spur a significant uptick in demand for solutions that can assist individuals in saving on their mortgage or refinancing their home loans. Emerging digital mortgage brokers, such as Ideal and Ringkas in Indonesia and Mortgage Master in Singapore, are expected to benefit from this growing demand.

Meeting homeownership aspirations

When it comes to home ownership, we expect to see an increasing demand for innovative solutions that can help the 213 million youths in Southeast Asia achieve their dream of owning their own place. Just as an illustration, interest rate increases from 1% to 6% on a 30-year mortgage can almost double one’s monthly instalments, making the already challenging homeownership goal even more unattainable. Business model innovations, such as rent-to-own solutions popularised by companies like DivyHomes and Zerodown, may see higher demand as aspirations of homeownership continue to increase. Regional rent-to-own companies that may benefit from this consumer trend include TapHomes, Tanaku, Cicilsewa in Indonesia, and Homebase in Vietnam. This trend may also be indicative of a larger shift towards alternative forms of home ownership in the region as the cost of traditional home ownership becomes prohibitive.

At its core, these rent-to-own solutions are net interest margin businesses and while they enjoy higher demand on the one hand, also suffer from the rising cost of debt. The ability to secure banks’ credit or cheap lines of debt will differentiate them from competitors.

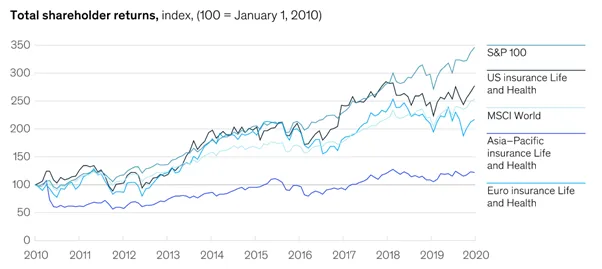

A new decade for life insurance

When it comes to life insurance, the last decade of low interest rates has been detrimental to the industry, especially those in APAC (see Total shareholder returns chart below). As we enter into an era of higher interest rates, life insurers and annuity providers will now have excess margins to invest in new technologies and strategies to improve the customer experience. We predict this will lead to more innovations and insurtechs emerging spurred by data-driven underwriting, cheaper distribution channels, and greater personalisation.

Capacity providers for various risk segments will also become more attractive as investment income begins to supplement underwriting income. This means that we expect to see more insurtech consortiums in the region applying for licences in the coming year, in line with regulatory support to increase insurance penetration in the region. For instance, Bank Negara Malaysia aims to issue five digital insurance and takaful operators (DITO) licences in 2023, while SEA Group’s SeaInsure Life Insurance just obtained a Life Insurance Licence in the Philippines and Oona Insurance acquired General Insurance licences in both Indonesia and the Philippines.

Source: SNL Financial, Mckinsey

Re-visiting the potential of AI in healthcare

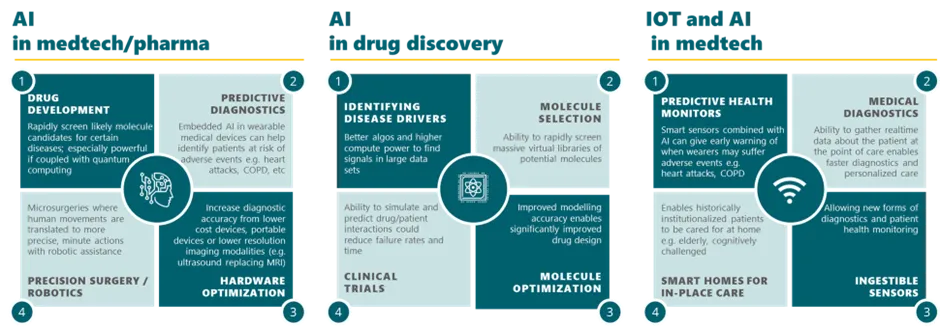

Moving away from macro trends to technological trends, we had previously written about how Artificial Intelligence and IOT could advance the healthtech industry, as well as the promise and potential of Artificial Intelligence in healthcare. With the rapid advancement of generative AI, we can expect rapid improvements across these technologies. For instance, predictive diagnostics can be supplemented with synthetic medical images that can be used to train and improve the accuracy of diagnostic algorithms. Personalised treatment plans for patients can be augmented with treatment options based on a patient’s genetic profile, medical history, and other factors. Startups in this space include Meshbio in Singapore and HealthVector in India which ingests patient health screening results and summarises it for easy interpretation and understanding. Like all the generative AI tools out there today, figuring out a business model will be the key to sustainable success.

Source:Integra Deeptech Thesis

Looking ahead

We continue to be bullish about the innovations bringing access and affordability to various sub-sectors in the region. This piece only scratches the surface on the opportunities that our new normal brings about. Startups in the money market sectors or digital banks with access to retail deposits are all poised to benefit as well. In terms of the implications of the current AI trend in Fintech and Healthtech, stay tuned as we will go into deeper details in a future article.