“A tectonic shift in intelligence” – Our report on Generative AI (GAI)

26 October, 2023

2024 in Review: Key Startup Trends and Predictions for 2025 in Southeast Asia

16 December, 2024

Revisiting our 2023 predictions and looking into 2024

21 December, 2023

Revisiting our 2023 predictions and looking into 2024

- Accelerating trend of Embedded Fintech

In 2023, we saw the acceleration of the embedded finance trend, where fintech is becoming a horizontal layer and embedding itself across all industries. In addition to embedded credit, savings, investments and insurance products, we also saw the rise of environmental credits being embedded as part of products and services. Regional start-ups such as Rize began embedding carbon credits into agri-production, while Cleanhub embeds plastic credits into fashion and consumer goods through partnerships with consumer brands.

We expect the trend to continue into 2024 as API adoption for embedded services grow and fintechs focus on channel partnerships to reach a wider audience with lower costs.

- Inflation driven cost-saving solutions

As inflation continued to rise in H1 2023, we saw an increase in adoption of solutions that eased cost pressures. Agritech players that aimed at lowering costs of production for farmers and in turn, reducing cost for end-consumers gained traction. On the B2B front, we saw an increase in interest for tech-enabled offshoring solutions such as cross-border payroll solutions and employer-on-record services for hiring in emerging Asia.

Although inflationary pressures are expected to ease in 2024, we expect this trend to continue in certain sectors such as agricultural and food production and healthcare.

Source: World Bank, S&P

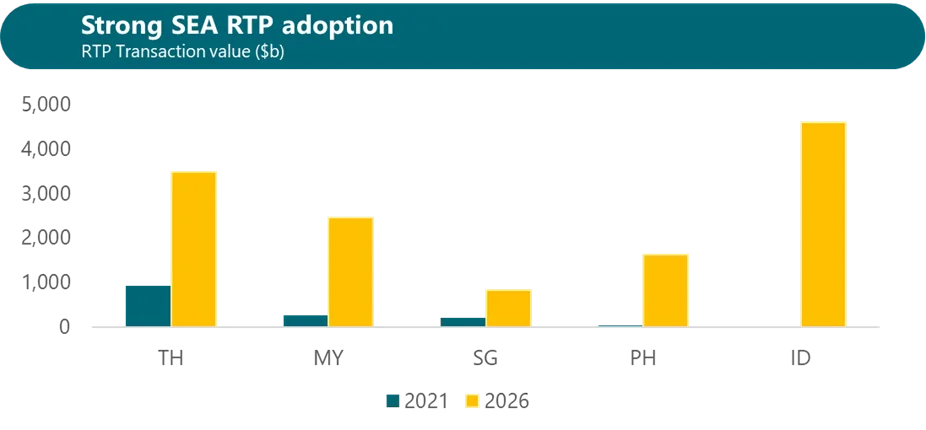

- Real-time Payments (RTP): Strong adoption with more focus on lowering costs

As we entered 2023, we predicted a surge in cost-efficient RTP options across Southeast Asia. Banks benefited from shared digital authentication, communication, and settlement services, while real-time transparency mitigated payment uncertainties for users. RTP is expected to continue to grow in the region with local government support catalyzing wider adoption.

Despite the strong adoption of over $1.5tn of RTP transaction value in 2021 growing at 15% CAGR, banks lost out in terms of fee income. As payment flows move from proprietary channels to a shared infrastructure, banks have lost control over pricing, with many interbank transactions offered to end-users for free. As a result, we saw a greater push for cross-border RTP solutions (i.e. Paynow-Duitnow-PromptPay, Paynow-UPI) which allows banks to monetize via FX spreads – between 2-3% for QR-based transfers. Despite uncertainty around RTP monetization, adoption will only continue to grow. We expect the focus to shift from innovation and new use cases to upgrading financial infrastructure to lower the cost of providing RTP, benefiting fintechs such as Sirius which helps banks re-architecture their backend to support low-cost microtransactions.

Source: S&P

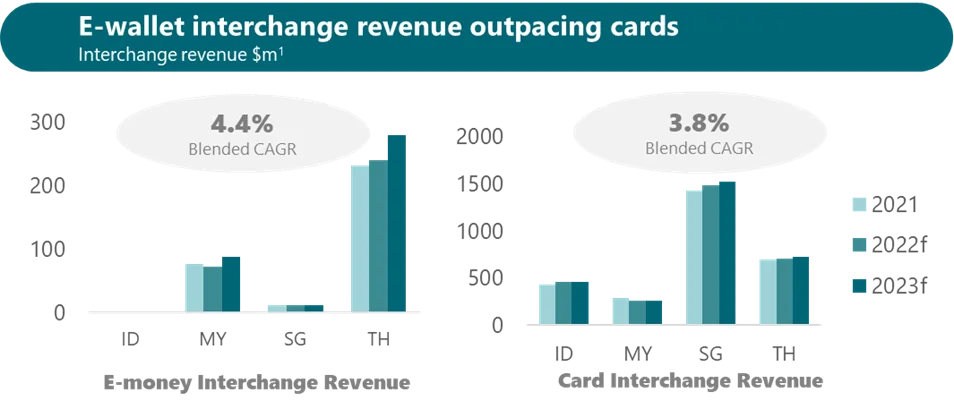

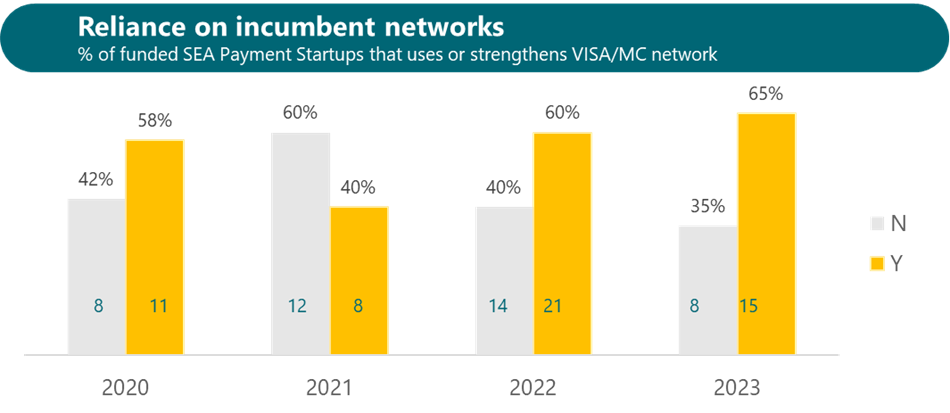

- Near-term focus on monetizable payments

Going forward into 2024, we expect continued traction in the tried-and-true models of e-wallets and card networks. We expect continued growth in regional e-wallet interchange revenues led by Malaysia and Thailand. E-wallets that were unable to maintain positive margins on a transaction-level due to top-up costs can also expect to defray some costs with additional interest income. Card transaction growth is expected to remain strong at 8.7% CAGR over the next 7 years. Over the past 3 years, we saw a slight resurgence of SEA fintechs that rely on the Visa/Mastercard network, often offering a carded solution and sharing in the interchange revenue. Given the increased monetization pressure on fintechs, we expect the trend to continue into 2024.

Source: S&P; 1Data complied as of 2022, excludes e-wallets and cards launched after April 2022.

Source: Integra Research, Crunchbase, Alternatives.pe, S&P

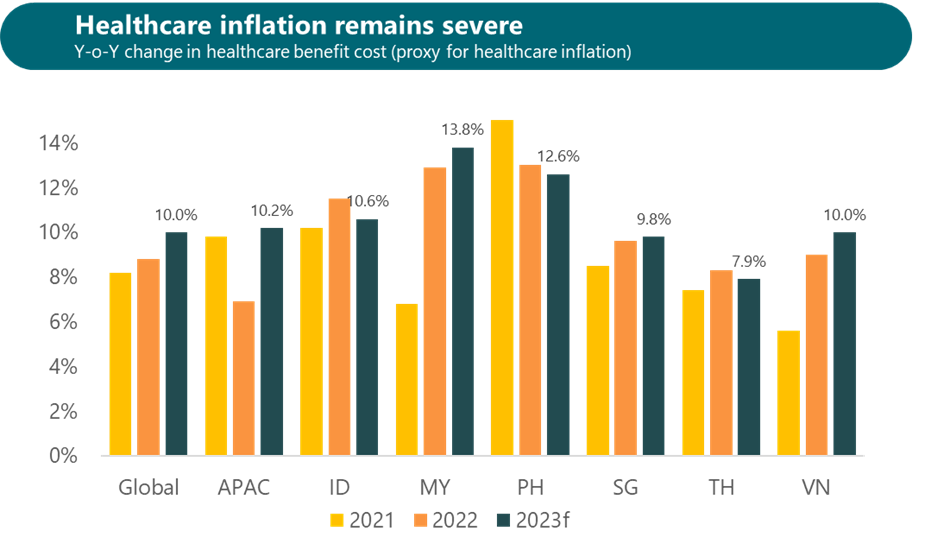

- Phygital solutions for healthcare inflation

In 2023, we expected a rise in solutions aimed at combating the surge in healthcare costs. Regional healthtechs benefited from this tailwind, having raised over $372m in 2023. What was unexpected was the renewed interest in tech-enabled solutions which addressed physical healthcare infrastructure in the region (i.e. HD Health for surgical space, Kindred for women health centers, HTC Renal for dialysis centers).

While Covid-19 accelerated investments into digital health, physical infrastructure is still lagging behind. For the region to reap the full benefits of digital health solutions that promise lower costs and better health outcomes – essentially, a true “phygitial healthcare experience”, significant investment in physical infrastructure will still be required. With healthcare inflation in SEA hovering around 10%, we expect to see a rise in the adoption of phygital healthcare solutions in 2024.

Source: Willis Towers Watson

- Bank acquisition spree

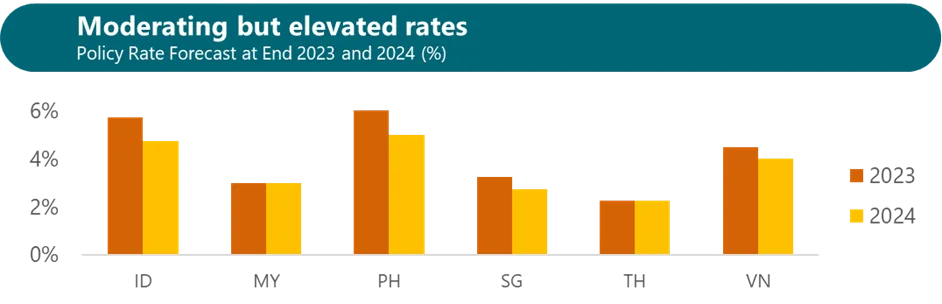

We predicted that the era of higher interest rates will spur innovation in life insurance, mortgage, and home ownership – which did not come to pass in 2023. Unsurprisingly, it was the regional creditech players that reacted and innovated – with creative risk management solutions and rural bank acquisitions.

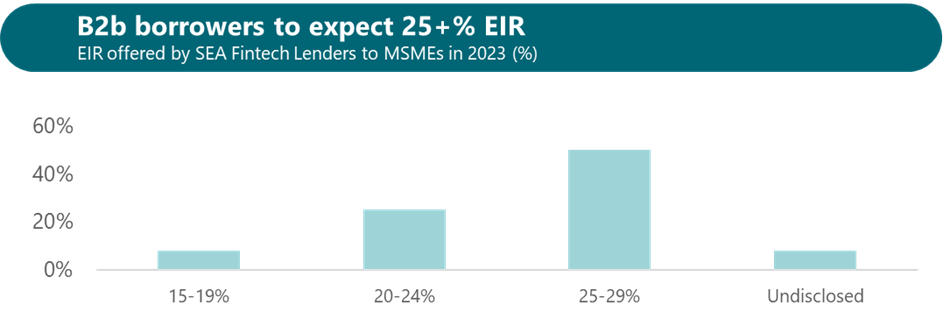

Rural bank acquisitions became a popular coping mechanism to tap on low-cost deposits, partly due to a regulatory-driven increase in the supply of rural banks for sale – most of which were sold for between 20-30%¹ of their deposit base. Regional regulators have increased capitalization of rural banks and closed sub-scale ones in a bid to strengthen the financial industry. The BSP closed 7 rural banks in the Philippines in 2023, in addition to the 27 closures since covid. Similarly in Indonesia, the OJK intends to reduce the number of rural banks by 400 to 1,000 by 2027.

While regional policy rates have remained elevated, they are beginning to ease, providing some relief for the majority fintech lenders who are facing pushbacks for charging interest rates above 25%.

Source: Fitch Solutions, S&P

Source: The Centre for Impact Investing and Practices

Remember the mega trend back in the mid-2010s about the unbundling of banks (see picture below)? We believe that the mid-2020s will see a reversal of that trend. The rise of fintechs acquiring banks, coupled with the trend of embedded financial services, has accelerated the “bank re-bundling” trend in the region – a topic we will cover in our subsequent posts.

Source: Cbinsights

Now onto to our 2024 predictions for early-stage investments in Southeast Asia.

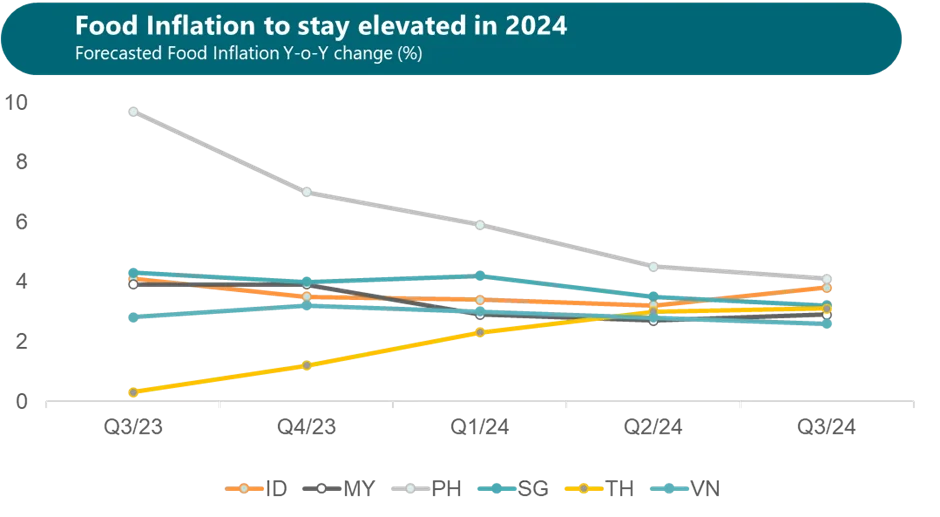

- Regional food inflation remains high, catalyzing agritech solutions

While overall inflation is expected to be moderate across the region in 2024, food inflation is expected to stay elevated across the board due to the impact of El Niño on the region, affecting major production of rice, coffee and cocoa. As a result, inflation in Thailand is also expected to climb moderately upwards despite an increase in supply of pork and vegetables, and lower energy prices as a result of government support measures for diesel and gas.

We continue to expect innovation from and investments into agritech firms that lower cost of production for farmers via lower cost of capital, IoT technologies to improve efficiency and increase yield (i.e. Chickin), an increase in market transparency and access (i.e. KitaFresh) and an improvement in input quality (i.e Crowde), as well as downstream players that reduce food wastage by better matching demand and supply (i.e TreeDots).

Source: EIU, Trading Economics

- Tapping on alternative sources of public capital

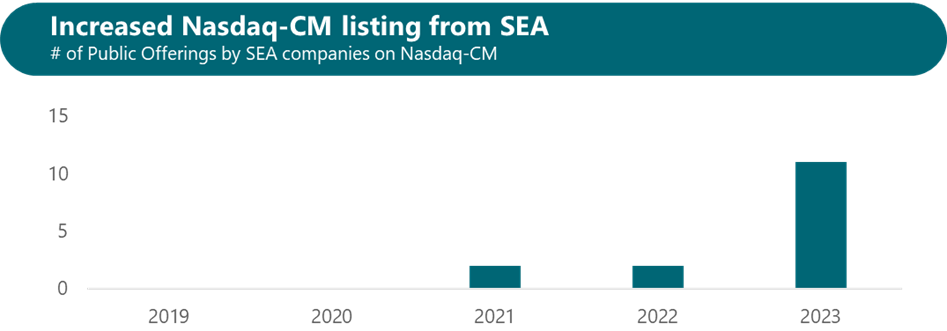

As capital dried up across the region in 2023, early-stage tech firms in Southeast Asia started to look towards the Nasdaq Capital Markets for funding and liquidity, which resulted in 6x more listings than in 2022. This small-cap tier on the Nasdaq exchange is tailored to early-stage tech companies that need to raise capital and bears similarities to the first batch of regional tech firms, such as iProperty and i, that listed on the ASX.

In 2023, start-ups such as Simpple, WeBuy and Ohmyhome opted for the IPO route instead of raising a traditional Series B or C. While the sample size remains small, we envisage that the market will become more familiar with such transactions, paving the way for earlier liquidity events over the next couple of years.

Presently, there are about 240² companies at Series B or C that raised their most recent round of funding within the last four years. Some of which might turn to a small cap listing – especially those who previously considered the SPAC route or are profitable and looking for liquidity.

Due to recent rate cuts expectations, investors’ sentiment towards the technology sector has improved significantly, with the Nasdaq-100 reaching its all-time high in December 2023. Should this continue, we will expect to see more of such listings next year.

Source: CapitalIQ, Nasdaq *Excludes SPAC listings

Source: Crunchbase

- Bridging the Growth-ESG expectations

European investors and corporates will turn to Asia for growth in 2024, as Europe’s projected 1% growth lags behind that of APAC’s at 4.2% and ASEAN’s at 4.6%. Start-ups seeking European investment or partnerships will face stricter ESG disclosure requirements, despite SEA’s less developed ESG reporting and management landscape.

This presents an opportunity for the region’s 32 ESG reporting start-ups, founded mostly after 2020, as more capital flows into SEA. These start-ups have raised over $66m³ and many are expected to mature in 2024.

See our extended Climate Fintech Report for more details.

- Political and Regulatory Uncertainty in H1 2024

Uncertainty continues to grip Vietnamese start-ups as they navigate the impact of Decree 13 on Personal Data Protection. Incumbents are taking a cautious approach and are avoiding sharing personal data (even with user consent) with start-ups. This has stalled investments and partnerships in areas such as credit and health scoring, until there is more clarity around how peers react and the extent of enforcement. We expect muted activity until the situation stabilizes in H2 2024.

In Indonesia, the upcoming 2024 elections have also stalled start-up investments. Government investments and contracts have largely been suspended as the market adopt a wait-and-see approach while awaiting clarity on the new administration’s stance on support for tech ecosystem, new capital, ESG efforts, and subsidies for various sectors.

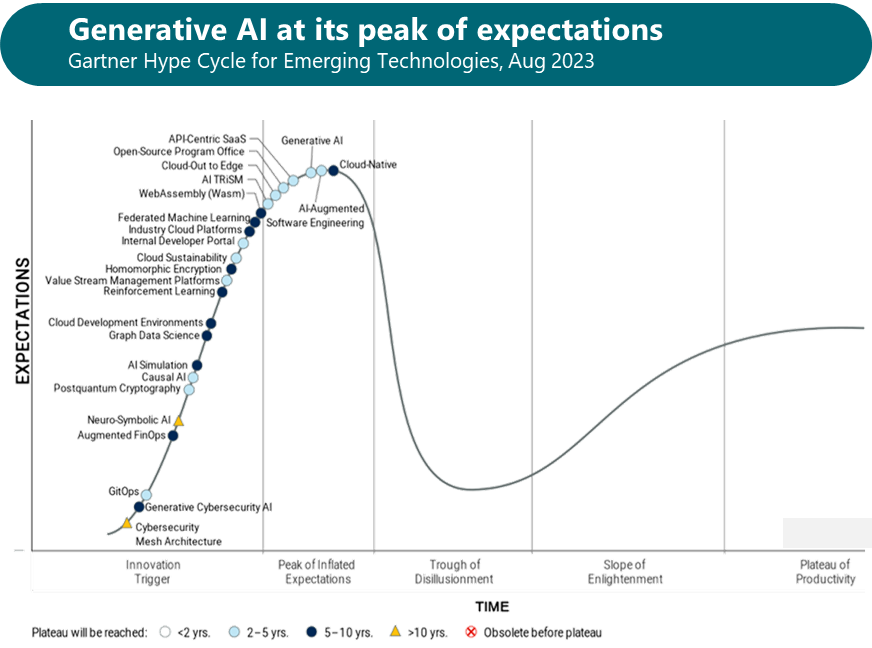

- Getting Generative AI past inflated expectations into production

Generative AI is poised to transition out of the hype cycle and experimentation into production. Today, firms are unable to fully utilize the technology in high-stakes applications (such as financial services and healthcare) – leading to disillusionment.

Most expect the technology to take between 2-5 years before reaching maturity and widespread adoption. For this to happen, we expect a new wave of start-ups that will solve the remaining challenges of output accuracy, usefulness, quality control, and workflow integration. We expect many of these solutions to be in the middleware and MLOPs space, although some examples include ChatGPT’s ability to allow users to provide “Customer Instructions” and Bard’s “Double-check response” function.

See our extended GenAI Report for more details.

Endnotes:

¹ Integra Research

² Crunchbase

³ Crunchbase, Integra Research

Written by Joshia Kwa, Principal at Integra Partners. Illustrated by Theodore Ng, Associate at Integra Partners.