The tech of e-commerce giants in the palm of your hands: Why We Invested in Graas

14 August, 2023

The democratisation of SME credit in The Philippines: Why We Invested in ProCredit

7 March, 2024The Future of Enterprise Technology in Financial Services: Why We Invested in Sirius

12 September, 2023

Why we co-led Sirius Technology’s Series A

It is June 21st 1988. Alan Alda of MASH fame stars in a tv-ad for the commercial launch of the IBM AS/400, IBM’s new midrange mainframe computer.

35 years later, and the below header of a job advert from a top 4 bank in Singapore hints at the longevity and success of IBMs enterprise systems in financial services;

“Application Maintenance Production Support (IBM/AS400/RPG/COBOL/CL), Core Banking”¹

The key focus here are the acronyms in parentheses:

- IBM/AS400 refers to IBM’s mainframe, developed initially in 1988;

- RPG is a programming language developed by IBMs in 1959;

- COBOL, a programming language popularised by the US department of defence, also first released in 1959;

- CL, or Control Language, launched by IBM in 1978, a scripting language for system administration.

This is not an exception to the rule, as an estimated 16,000 banks globally still run on a version of the AS/400 to power their core, including 8 of the top 20 banks in Southeast Asia. High switching costs are a feature of all enterprise technologies, and banking is no exception.

In fact, the core banking provider built on top of IBM AS400 and serving these 8 banks derives 76% of its 2022 revenues from “maintenance and enhancement services”. In SaaS parlance, excellent Net Revenue Retention. In human language, extensive support and maintenance to keep things running, and upgrading existing systems to accommodate new features, workflows, or user experiences.

Saddled with legacy systems, banks perform a delicate balancing act to satisfy strict regulatory requirements on the one hand whilst at the same time trying, with varying degrees of success, to keep up with changing customer demands.

On the customer side, banking anytime, anywhere, real-time onboarding, underwriting and decisioning, personalised pricing, and data sovereignty are fast becoming necessary requirements to a successful bank-customer relationship. To make matters more complicated, as we have written here previously, banking is fast becoming embedded, and the number of simultaneous channels, partnerships and integrations is increasing exponentially.

Meanwhile, regulators impose strict operational resilience requirements on banks. DBS, an otherwise darling of digital transformation, was asked to set aside an additional $1.6 billion in risk capital after repeated technology disruptions earlier this year.

So what should you do if you are a bank CIO or CEO?

Enter Sirius

Sirius has existed for less than 3 years, and yet today powers financial services applications for over 50 million users worldwide, ranging from Thailand to Colombia. Among its customers are credit card companies, retail brokers, and retail banks.

The key insight of the Sirius team was that launching scalable, affordable and flexible digital customer solutions does not have to go hand-in-hand with a big bang migration to an entirely new technology stack.

In fact, two key items that are of paramount importance but that do not require high performance cloud computing are a financial institution’s systems of record (the accounting records of your bank balances) and its regulatory reporting engine. Both need to work, and both (mostly) work perfectly fine with existing systems.

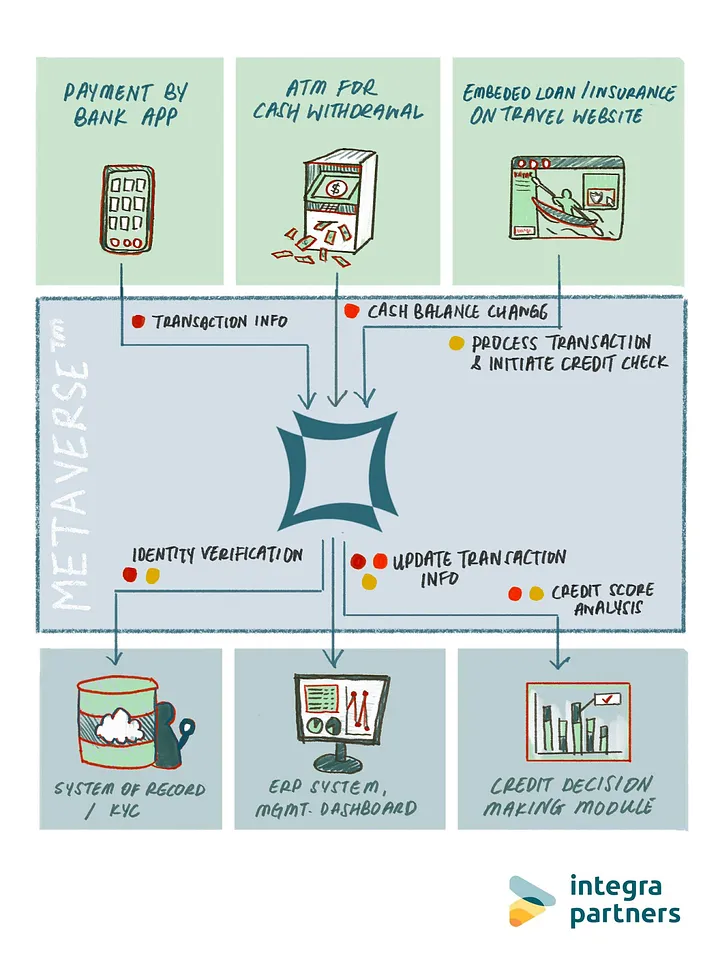

For everything else, especially the online use cases driven by various digital trends, Sirius offers Multiverse, a scalable, flexible and cost-effective foundation to launch and embed digital products. At the core of Multiverse is an event driven mesh application architecture, in which services built with appropriate granularities publish and consume events dynamically to offer a new model of orchestrating business processes without compromising the essential integrity demanded in financial services. Such processes can be as simple as payments by a bank mobile app, cash withdrawal from an ATM, or as innovative as paying for plane tickets using instantaneous disbursement of a digital loan and purchasing travel insurance at the same time using loyalty points. Multiverse performs equally well across industries and sub-segments of markets, as subscribing to and publishing of events works the same whatever the business workflow being orchestrated.

Whilst this seems logical, this is a radically different approach from most existing digital initiatives, which are really custom integrations of new data silos on top of existing cores, leading to a multi-siloed enterprise architecture.

On top of Multiverse, Sirius offers multiple composable solutions, building blocks that allow clients to “compose” their front-end workflow, which can also include third party apps and integrations.

There are various providers of middleware layers globally, but few who have as deep an understanding of financial services as the Sirius team, led by Jing Li.

Prior to founding Sirius, Jing and his core team spent years at WeBank, where Jing was the Lead Architect, building the technical foundation of what became the world’s largest digital bank with over 340 million customers, and being the first bank to successfully pursue an embedded banking strategy at scale. Now based in Thailand, and expanding throughout Southeast Asia and Latin America, the team brings its industry best practices to Sirius.

The market opportunity in Southeast Asia, and globally, for Sirius is almost unbounded. Banks, brokers, card companies, agency banks, insurers, can all benefit from Sirius’ event-driven approach to digital transformation. Dreaming of an even bigger future, the technology behind Sirius can be applied in any industry with high volume and velocity of data, for example in healthcare, energy, logistics, retail, and e-commerce.

We are proud to partner with Jing and his team to co-lead Sirius’ Series A round of funding which was announced last month. Together with our co-lead Cento Ventures, and co-investors MVP and Shinhan Financial, we look forward to supporting Jing and his team in bringing their best of breed enterprise software capabilities across the region and beyond. True global multi-billion dollar enterprise technology opportunities do not come along every day in Southeast Asia, but this is undeniably one of them.

If you would like to learn more about Sirius, take a look here or reach out to Sirius directly here.

¹Listed on 30 July 2023