Naluri, Wagely and the future of employee well-being

11 June, 2021

The sun rises in the east: Philippines’ startup breakout moment (Fintech Perspectives)

29 March, 2022

Notes on the emergence of mass retail investing in Southeast Asia

16 September, 2021

At Integra Partners, we believe that becoming an asset owner is key to economic empowerment.

Naval Ravikant, the founder of Angel.co, aptly describes in this podcast: “wealth is assets that earn while you sleep”, meaning that the only way to grow wealth is to have other people work for you, i.e. to own equity in other people’s businesses¹.

During the last 18 months, the ability or inability to be an asset owner has been one of, if not the key driver behind growing wealth disparity. As asset prices have soared across the board, the owners of assets, whether equities, real estate, or cryptocurrencies, have thrived. Most of these people are knowledge workers and, to put it bluntly and overly simplistically, “we” have all been sitting at home in lockdowns toggling between Zoom, our brokerage accounts and crypto wallets seeing our wealth increase.

Unfortunately, the vast majority is not benefiting. Blue collar workers all over the world, and certainly in emerging South and Southeast Asia, live paycheck to paycheck in the best of times. Whilst the benefits of compounding small and consistent investments are well known, these people (until recently) did not even have a viable way to make such investments and become asset owners. Brokerage accounts have long been the privilege of the mass affluent.

Traditionally, the only place to invest is cash, which depreciates in value ever faster as central banks print more of it. Gold may have been an alternative, but that equally is not an asset that “works” for you. Rather its main advantage is that the barrier to spending your savings is slightly higher as one needs to convert it to cash in order to be able to spend it.

With no savings or investments, millions of blue collar workers have experienced a temporary loss of part of or all of their income. The World Bank estimates that 97 million people became newly “extremely poor” in 2020, a stunning increase of 11.6%². 2020 was a terrible year for alleviating poverty.

So while the owners of capital have been getting richer (at least on a nominal basis!), your Ankas driver in Manila, barista in Jakarta, or the factory worker that produces your dental aligners or jeans has likely gotten significantly poorer over the last 18 months.

However, a new wave of fintechs is finally empowering blue collar workers to become micro-asset owners.

In this post, we dive into the world of retail brokerage and explore how empowering more people to become asset owners through investing can create a positive impact.

We look at the implications of asset ownership for a typical Southeast Asian household, the options available to them, the real cost of ownership, and assess the current market environment.

While the majority of investment in emerging markets is typically geared towards credit, it is time to rethink this approach. Perhaps investing in empowering asset ownership is the most impactful trade one can make.

4 different scenarios of wealth generation

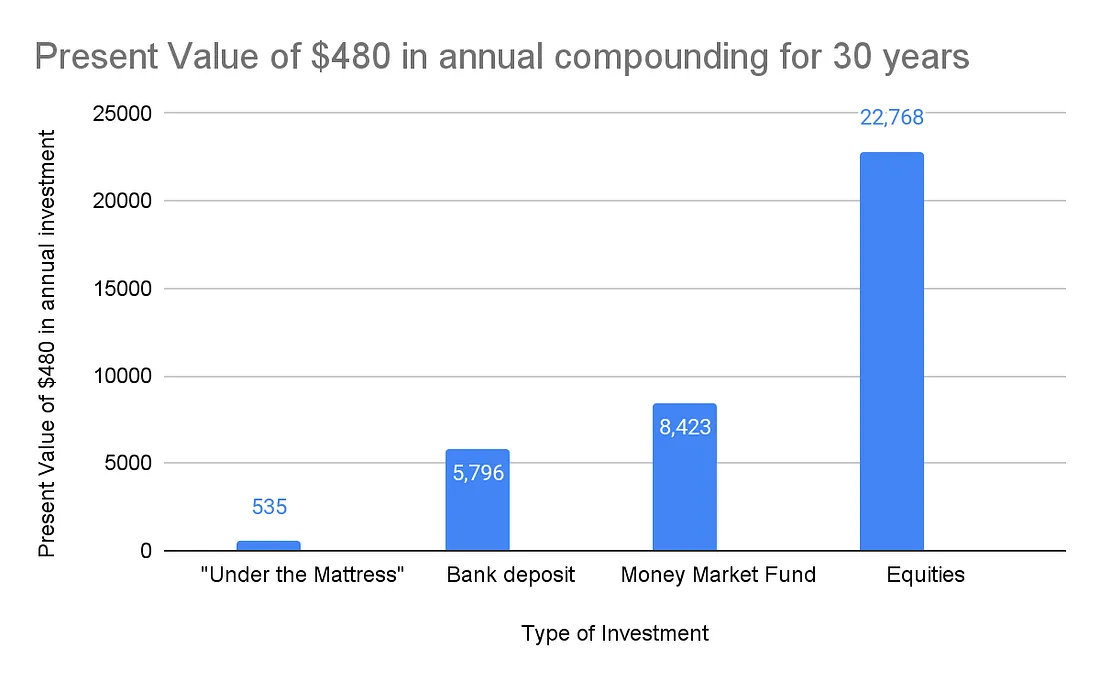

Using historical long-term asset returns, we have estimated the present value of 30 years of consistent investment for a typical blue collar working family in Southeast Asia across 4 different strategies:

- cash under a mattress

- cash deposited in banks

- cash invested in money market funds, and

- cash invested in equities

To simplify our analysis, we have assumed $40 in monthly savings, invested at the start of each year³. For “cash under a mattress”, we have assumed that 50% of annual savings is ultimately spent on emergencies, celebrations and education, etc.

Using actual inflation rates, long-term asset class returns, and costs of transacting, the figures below reflect the present value of 30 years of investing in today’s cash in respect of each strategy:

The math is simple. Investing in equities yields a 42.5x better return than saving under a mattress. Saving under a mattress, or holding cash in bank deposits is a terrible strategy. The 42.5x return differential explains that long-term asset ownership is what truly drives wealth creation. Conversely, a lack of long term asset ownership is destined to keep you poor, especially if you earn a few hundred dollars a month to begin with.

Saving under your mattress guarantees to trap you in poverty. In present value dollars, putting $40 under a mattress will yield less than $1k in savings after 30 years. Saving in a bank account is slightly better, but this still results in negative real returns net of inflation and additional costs such as account maintenance fees. If you could invest in money market funds and make at least inflation, this would yield about $8.4k in today’s money, which is a considerable sum for a blue collar worker, and likely to help the next generation to a better future (even if they just keep compounding the same amount!). Investing in equities and generating a long-term annualized real return of 6.21%, offers the most attractive returns and would be equivalent to a present value of $22.7k.

Just for fun: if you compound $40 at an annual yield of 100% over 30 years, you will receive $112 billion in today’s dollars, which, if anything, tells you that the current returns in crypto are unlikely to sustain. That’s a different topic for a future post.

Like all aspects of financial services, technology is redefining retail investing. Today, it is possible to be an asset owner even if you only have a few dollars to spare. Blue collar workers can own equities, even at a micro level. Whilst there are many factors that contribute to sustainable and equitable economic growth, we believe this is one of the most important areas of investment.

We look at the various trends that have made this possible and review some exciting companies that directly or indirectly target an aggregated long tail, which is VC speak for serving a large group of customers that traditional players find too unattractive to serve.

Access, Affordability, Responsibility

At Integra we look at fintech with a specific investing lens. We look for fintechs that contribute to increased access, increased affordability, and above all, offer a responsible product that solves a real problem for its customers. We have set out below some market trends that have improved access as well as affordability. We discuss responsibility separately in a following paragraph:

- Ability to open a bank account / wallet

- Ability to perform digital KYC / onboarding

- Decreasing minimum deposits or ongoing fees and charges

- Creation of new asset classes by fractionalizing shares, offering new asset classes

- Fintechs that work with employers to provide earned wage access, micro-savings and micro-investments, as well as financial literacy education

- Cryptocurrencies, and play-to-earn

The first two trends have been an investment theme of ours for a few years and much progress has been made. Together with Brankas, we recently released a report on embracing Open Finance in Southeast Asia, which explores how Brankas supports digital onboarding which thus decreases the costs incurred by banks and wallets in relation to the onboarding and servicing of customers.

In terms of minimum deposits and ongoing fees, fintechs tend to be a lot more aggressive than traditional players. Many banks charge monthly maintenance fees of $1 or more, which is damaging on returns if you are saving $40 a month. Minimum deposits have been a deterrent for many, presenting a significant hurdle to opening an account.

Fractionalization of shares is a great development. For example, because Amazon trades at approximately $3.5k today most people cannot afford a single share. With fractionalisation, you could own 1% or even 0.1% of a share of Amazon. Furthermore, new asset classes like crypto are available to anyone with a mobile phone, which is a great improvement inaccessibility compared to traditional brokerage.

Fintechs offering retail investing come in many different forms and includes super apps like Grab and GoJek which offer access to fund investing, dedicated retail brokerage startups like Stashaway and Syfe that cater to the mass affluent market, and local players such as Pluang and Finhay which target young and digitally literate workers in Indonesia and Vietnam. Further, there are various crypto exchanges offering a variety of tokens to trade. While these are generally positive developments, there are a few notes to make and room for improvement, all of which relate to responsibility.

First, a lack of fee transparency remains an issue. Most retail brokers are actually reselling third party asset management products. For example, a retail broker could offer a “global equities fund” that is actually a white label of an existing fund managed by an existing fund manager (active or passively managed). While mainy retail brokers claim to have “0 management fees”, they are not actively disclosing that the returns are net of fees to be paid to the underlying asset manager. Under a so-called “retrocession fee agreement”, the asset manager typically charges the broker a management fee (between 30bps — 150bps per annum depending on the underlying product), and then pays 50% of the management fee back to the retail broker so both can make a profit. Specifically in crypto, fees are incredibly high. Temporarily, this appears masked by the higher returns generated. This however, should not last (both the fees and the returns) as the industry matures.

Second, the UX / UI of retail brokerage is often gamified. For example, on many platforms, confetti rains on your screen when you buy a product or make a trade. This is fun but not necessarily desirable as it may encourage people to trade more, whilst what they most likely should be doing, is buying and holding a broad index tracker for the long term. The point of course being that when you trade more, the platform makes more money, and you make less.

Third, retail brokers need to be accurate and transparent in the information they provide to their customers. Many retail brokers compare “their performance” to the “industry average” and show nice charts with consistent outperformance. It’s not clear however, what benchmarks are used and whether the relevant fees have been taken into account, whether the outperformance is for a selected product or across all products etc. Consistent outperformance in public markets is extremely hard over the long run, and retail investors are often better off buying and holding broad indices in the long run.

Fourth, some retail brokers offer products that can lead to financial ruin. Nobody needs 100x leverage on BTC, except the platform that is making a market in this product and earning a fee whichever way the price goes. Equally, options on equities, accelerators and decelerators and other structured products are nothing but a casino game in the hands of most retail investors and are best avoided.

Finally, the vast majority of platforms target the mass affluent or the wealthy, and do not provide a solution for blue collar workers (e.g., someone who can save $4 — $40 per month). This is understandable, as higher balances mean higher lifetime value of an account. However, technology now allows for efficient aggregation of the long tail of smaller, emerging investors, and this is what is driving a new generation of companies that specifically serve younger, less affluent segments of the market.

Finally… there is an option for blue collar workers to be invested, too.

At Integra, we have partnered with two Earned Wage Access providers wagely and Advance.ph. We see these platforms as the ideal distribution platforms for micro-investments to blue collar and gig workers, who would typically be first-time asset owners.

A tailored approach is necessary. The product needs to be easy to use and simple to understand. Workers need to be educated on how micro-investment works and what the benefits are. Fees need to be low and transparent. Ideally, employers pick up some of the costs to play an active role in building a more financially stable workforce given that this often results in higher productivity and lower turnover. None of this is easy, but it’s important. The payoff if successful is huge: turning all Southeast Asians into asset owners.

We believe that contributing to a good cause can be a great investment too.